Posts Tagged ‘level 3 processing’

How to Lower Interchange Fees – Revolution Payments

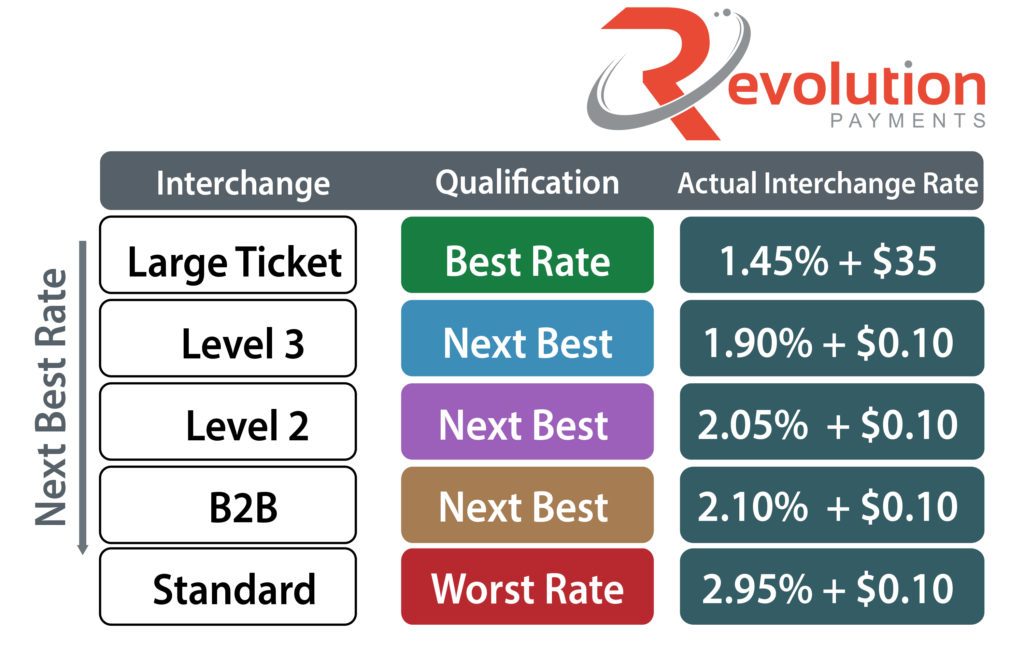

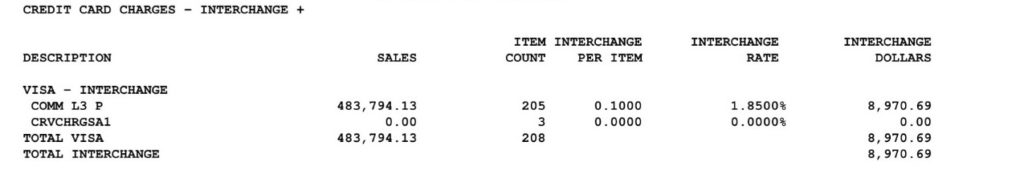

I’m going to explain how to lower interchange fees by including level 2 and level 3 line item detail on your B2B and B2G transactions. This is geared towards businesses that primarily accept credit cards from businesses or government vs. consumer cards. You can implement some of these ideas to help reduce the interchange fees you…

Read MoreGovernment contractors Why pay 2.70% vs 1.9%?

Government contractors Why pay 2.70% vs 1.9%? With the many challenges facing contractors today, it’s no wonder that they have relied on their banks to set-up their credit card processing. It’s regrettable that many in the contracting industry are unaware of the advantages that correct processing solutions can present. To support acceptance of corporate &…

Read MoreReduce Interchange Fees Associated for Accepting Government Purchase Cards

Revolution Payments Reveals has a New Service to Help Government Vendors Reduce Interchange Fees Associated for Accepting GSA, Government Purchase Cards This solution will optimizes every credit card a government contract accepts to the lowest possible interchange rate. Behind the scenes this powerful automatically reclassifying government purchase cards and commercial cards to level 3 interchange…

Read MoreLevel 3 Payment Processing Solution For QuickBooks Online

Revolution Payments reveals a Level 3 Payment Processing solution for QuickBooks Online users. Level 3 processing can reduce the interchange for accepting credit cards from other businesses and or government by up to 43%. Interchange is responsible for the bulk of the fees you pay to accept credit cards; it’s also paid to the card issuing bank.…

Read MoreAccepting GSA SmartPay Cards

When it comes to accepting GSA SmartPay cards, it may be time to make some changes. Implement 21st century payment processing technology is required to keep your business both competitive and compliant. Accepting GSA SmartPay cards requires processing technology able to capture level II and level III payment data. Government & Commercial cards accepted without level…

Read MoreDiscover Hidden Savings With Revolution Payments Interchange Optimization Service

Discover Hidden Savings With Revolution Payments Interchange Optimization Service by qualifying for lower interchange categories on B2B and B2G transactions, and avoid potential downgrades. There is no cost for merchants for using this service. In exchange for helping you reduce your expense of accepting commercial cards, revolution payments keeps 50% of the savings from the…

Read MoreGSA Vendors Double Your Profit Margins!

GSA Vendors Can Double Profit Margins By Accepting Credit Cards from the Government Correctly! Did you know Visa and MasterCard created special rates for vendors who accept government credit cards that lowers transaction cost by 40% Qualifying your transactions Under 2% whether you key, process over the internet, or swipe them? If not, don’t worry. Even though level…

Read MoreRevolution Payments, leading advocate and Level 3 credit card processing consultant serving the B2B & B2G payment space.

Revolution Payments is leading advocate and Level 3 credit card processing consultant serving the B2B & B2G payment space. We are a full service payment provider for Business-to-Government (B2G) & Business-to-Business(B2B) companies that require a provider able to support the qualifications required for Level-2 & Level-3 credit card processing Interchange rates At Revolution Payments, we do…

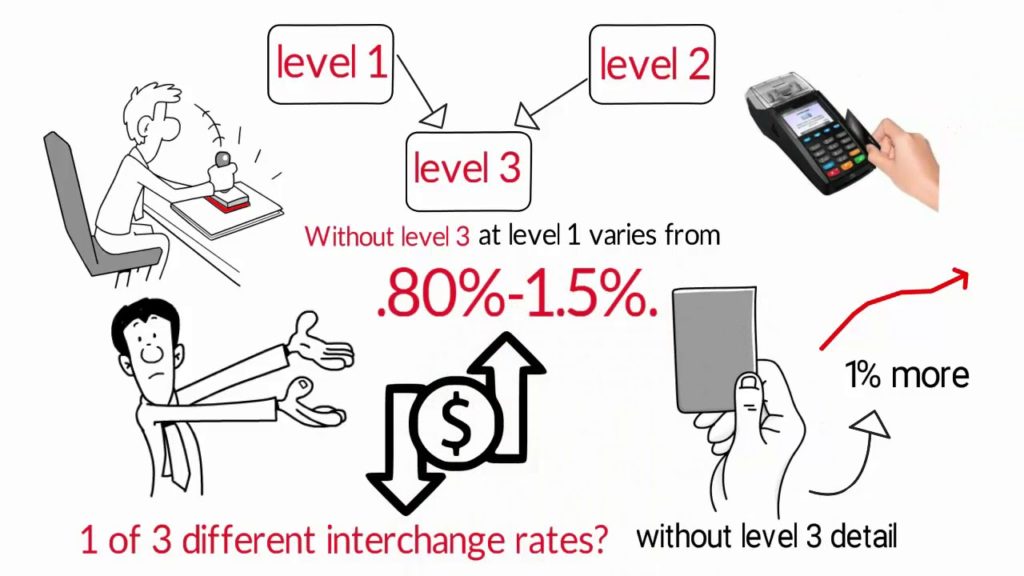

Read MoreGSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing

GSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing! What is Level 3 processing? Level 3 processing is a more sophisticated way of accepting commercial, business, purchase & government cards that allows any business selling to other companies or government to lower transaction cost by 30%-40% from (interchange rebates)…

Read MoreAccepting Commercial Cards and Level 3 Processing

I’m going to explain why accepting commercial cards and level 3 processing is SO important. If fact, its so important that accepting a commercial card without it and you lose 1% of revenue that has nothing to do with your processor or your rate. After 24 years in the payment space and talking with thousands…

Read More