GSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing

GSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing! What is Level 3 processing? Level 3 processing is a more sophisticated way of accepting commercial, business, purchase & government cards that allows any business selling to other companies or government to lower transaction cost by 30%-40% from (interchange rebates)…

+ Read MoreLevel 3 Merchant Account

I will explain why a level 3 merchant account is a must if you accept commercial, B2B or government purchase cards. Accepting these cards without a level 3 merchant account, your cutting into your bottom line. For many companies, credit card processing fees rank in the top 5 of all expenses. I can appreciate that…

+ Read MoreAccepting Commercial Cards and Level 3 Processing

I’m going to explain why accepting commercial cards and level 3 processing is SO important. If fact, its so important that accepting a commercial card without it and you lose 1% of revenue that has nothing to do with your processor or your rate. After 24 years in the payment space and talking with thousands…

+ Read MoreLevel 3 Processing for Commercial Transactions

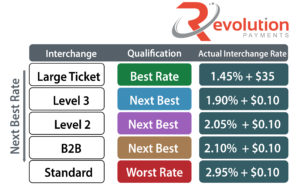

Its extremely likely level 3 processing (line item detail) lowers your interchange cost of processing B2B & B2G transactions by 1% or more! Level 3 processing for commercial transactions is a great way to lower interchange cost before processors add their fee. You probably already know this but, whenever you accept a credit card from…

+ Read MoreWhat is Level 3 Processing

What is Level 3 processing? To understand why level 3 processing is so important if you accept commercial or government credit cards, keep in mind 80% + of the fees businesses pay to accept credit cards (interchange) goes directly back to the bank that issued credit cards. Processors receive no revenue whatsoever from interchange. One…

+ Read MoreHow much can level 3 processing save you?

This post shows how much level 3 processing can save you on your (B2B) business-2-business and (B2G) business-2-government transactions. Even if you have a great rate, accepting b2b, commercial or purchase cards without level 3 detail, you are always going to pay about 1% more than the best rate you can receive from a processor.…

+ Read MoreGovernment P card processing – Level 3 processing

Government Vendors: Don’t Leave “Rebate” Money on the Table Add up to 1.5% to your bottom line for Accepting Gov & Non Gov Commercial & P-Cards Please note, this is much different than your standard merchant account and will effectively add up 1.5% to your bottom line On ALL Government, Commercial & Business transactions…

+ Read MoreLevel 3 Credit Card Processing, Is it right for you?

With the many challenges facing contractors today, it’s no wonder so many are relying on their banks or existing credit card processors to set them up to accept Government P-cards. It’s regrettable that many in the contracting industry are unaware of the advantages available for accepting these cards correctly To support acceptance of corporate &…

+ Read MoreLevel 3 credit cards processing GSA Vendors

Vendors, Did you know Over 15 years ago, MasterCard & Visa created special rates to support Purchase Card programs reducing a vendor’s transaction costs (Interchange) if Level-3 line item detail information is processed with a transaction? Yet, 3 out of 5 vendors are still not set up to participate. By providing Level-3 data, a supplier…

+ Read MoreLevel 3 Credit Card Processing

Revolution Payments developed a solution that automatically reclassifies the commercial, government and B2B credit cards you accept to level 3 interchange rates, thus adding about 1.5% new interchange revenue to your profit margins, w/o changing your processors rate. Before you disregard this information I’d like to remind you that the service we are providing has…

+ Read MoreAbout Us

At Revolution Payment Systems, our entire focus is on delivering reliable and secure payment solutions to help businesses succeed in an increasingly complex global marketplace.

Connect With us

Revolution Payment Systems is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, CA. American Express requires separate approval.

www.revolution-payments.com Revolution Payment Systems is an Elavon Payments Partner & Registered ISO/MSP of Elavon, GA

© 2016 Revolution Payments | Privacy Policy | Website Developed by Silentblast